US Navy eyes two-submarine delivery rate: Due to work hiccups that disrupted plans to deliver two attack submarines this year, the U.S. Navy and the submarine industry intend to start delivering two attack submarines on a regular basis by 2024.

Industry sent one attack sub, the Hyman G. Rickover, to sea testing in December of this year, with plans to deliver the second, the New Jersey, early in 2019.

Attack submarine programme executive officer Rear Adm. Jon Rucker stated that in order to start delivering two subs annually in 2023, his office implemented new construction and delivery schedules in February.

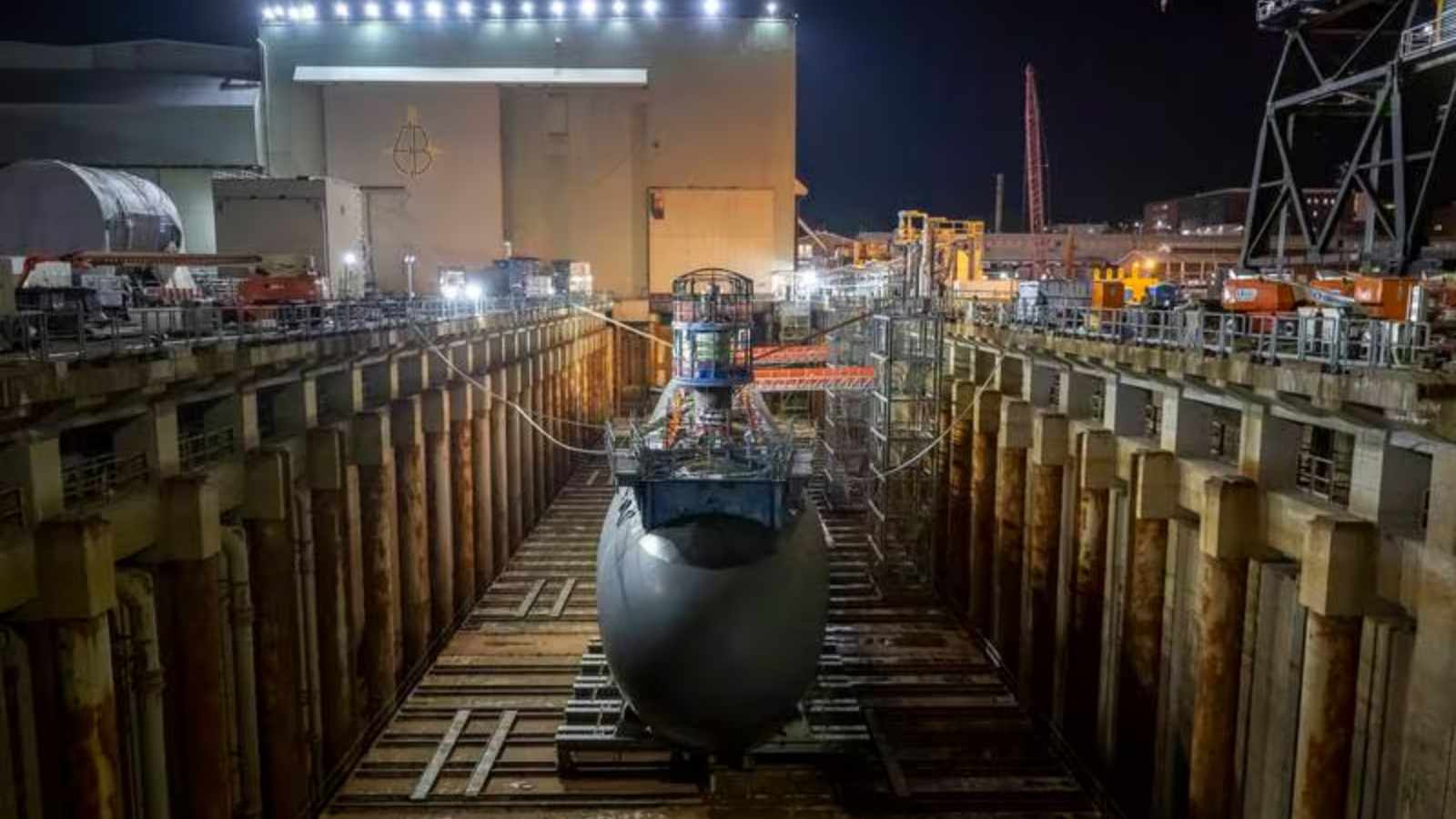

Aside from a few unidentified problems that surfaced during the summer, General Dynamics Electric Boat was forced to postpone the launch of a submarine in the spring due to a malfunctioning launch pontoon. This resulted in an accumulation of modules and parts since the company lacked the room to receive fresh material into its construction facilities until the boat departed.

Although Rucker described the summer as a low point for the manufacture of Virginia-class attack submarines, he added that overall production rates had already increased and that by fiscal 2028, they should return to a 2.0 delivery cadence.

The submarine production process, including manufacturing, outfitting, assembly, final testing, and delivery, is moving along at a pace that would enable the Navy and industry to build that many attack submarines annually. This is known as the “1.3 attack sub construction cadence.”

Naval Submarine League

Speaking at the Naval Submarine League’s annual symposium, Rucker stated that by the end of the year, the work in all phases of construction will be “rebalanced” following the backlogs this summer, and the cadence should be able to continue slowly increasing towards the 2.0 objective.

In order to solve some of the cadence concerns, the Navy has invested billions of dollars in the submarine-industrial base since FY18. At the conference, Matt Sermon, the executive director of Programme Executive Office Strategic Submarines, told Defence News that investments from FY19 through FY21 targeting sequence-critical parts that were arriving late would benefit submarines currently under construction. This would avoid having to halt work and wait for the part, or continue without it and attempt to install it later in a costly or disruptive manner.

“We’re going to see improvements in that space” for the Block V Virginia-class submarines and the second Columbia-class ballistic missile submarine, whose formal construction just started last month, Sermon continued, as the vendors use the Navy’s funding to expand facilities or enhance workflows, ensuring on-time delivery of their parts.

Defence ministry clears acquisition proposals worth Rs 7,800 cr

US Navy eyes two-submarine delivery rate

Spending in workforce development would also help currently building boats, according to Sermon, since major suppliers have been able to acquire highly experienced craftspeople from official training pipelines like the Virginia-based Accelerated Training in Defence Manufacturing centre.

The Navy intends to support roughly fifty supplier development programmes in FY24. The supplier development programmes continue to focus on sequence-critical parts, according to Sermon. These parts may be new parts that are beginning to arrive late and endangering building deadlines, or they may be parts whose manufacturers have already received some funding but still require additional assistance.

Sermon said, “If there is any money left over, the Navy will start going after other suppliers who aren’t expected to keep up as the workload increases in the upcoming years or who can’t keep up with delivery schedules today.”

The head of the Navy’s submarine-industrial base programme, Whitney Jones, stated that her department is attempting to use this funding more wisely.

In the past, we’ve frequently examined how we’re making these investments at the supplier level, and the results have been extremely whack-a-mole: for one supplier we deal with, five more arise. It’s difficult. Our focus now is on assessing the state of a commodity group or market sector and determining where investments are necessary to maintain that state, the spokesperson told Defence News.